BOOK A CALL NOW

Trusted Local

Mortgage Advice

Reach out to us today for prompt assistance and professional advice on finding the right mortgage solution for your needs. We'll assess your options and offer tailored recommendations so you can make informed decisions with confidence. Count on us for reliable, expert mortgage guidance.

We have helped clients of all circumstances over the years, chances are we've helped someone just like you!

Customer Service is at the heart of our business and we recognise that ‘one size does not fit all’, so we will work closely with you to find the best rate to meets your exact requirements, whether on Residential Mortgages, Buy-To-Let* (BTL) or Commercial Mortgages.

Customer Service is at the heart of our business and we recognise that ‘one size does not fit all’, so we will work closely with you to find the best rate to meets your exact requirements, whether on Residential Mortgages, Buy-To-Let or Commercial Mortgages.

*Please note that some forms of Buy To Let mortgages are not regulated by the FCA.

Why Choose Us?

25 Years of Experience and Expertise: Our team brings over 25 years of experience as active landlords and mortgage brokers and our deep knowledge in property investment and mortgage finance enables us to offer valuable insights and tailored solutions.

A Truly Personalised Service: We prioritise customer service and aim to be one step ahead, ensuring all clients receive prompt updates and assistance throughout the mortgage process. Our team takes pride in delivering exceptional service, as reflected in our 5-star Google reviews.

Fully Team Commitment: The entire team at Alton Mortgages is dedicated to supporting clients and ensuring their needs are met. This collaborative approach enhances the quality of service and client satisfaction.

ADVISOR

An experienced, knowledgeable, and friendly Advisor working just for you.

EMPLOYMENT TYPES

Paye employee, Fixed term contract, sole trader, Limited Company Director, CIS mortgages, Buy-to-Let Property landlords

BESPOKE MORTGAGES

Through established lender contacts and relations we can help you secure the best deal for your needs.

Meet the Alton Team

Richard and Gill Alton, found their path into the mortgage industry after Richard's corporate career led him to pursue a new direction.

What began as a leap of faith evolved into Alton Mortgages in 2005, born out of unexpected opportunities and a shared commitment to exceptional customer service. Initially a solo venture, the business expanded when Gill, joined Richard full-time in 2007.

Their growth story includes multiple office moves to accommodate expansion, and they are now boasting a team of eight dedicated staff members. Richard's early investment in Buy to Let properties (BTL), predating mainstream BTL mortgages, paved the way for a robust portfolio managed with expertise by Gill.

At the core of their success is a relentless focus on customer service, fuelled by the team's dedication to staying ahead and exceeding expectations.

To arrange a quick call back, simply complete this survey

Our highly experienced Advisers are ready to help you with either buying or re-mortgaging a home, protecting your property and lifestyle along with saving you time and effort, ensuring you have a competitive deal right for you.

To arrange a quick call back, simply complete this form

Our highly experienced advisors are ready to help you with either buying or re-mortgaging a home, protecting your property and lifestyle along with saving you time and effort, ensuring you have a suitable deal for you.

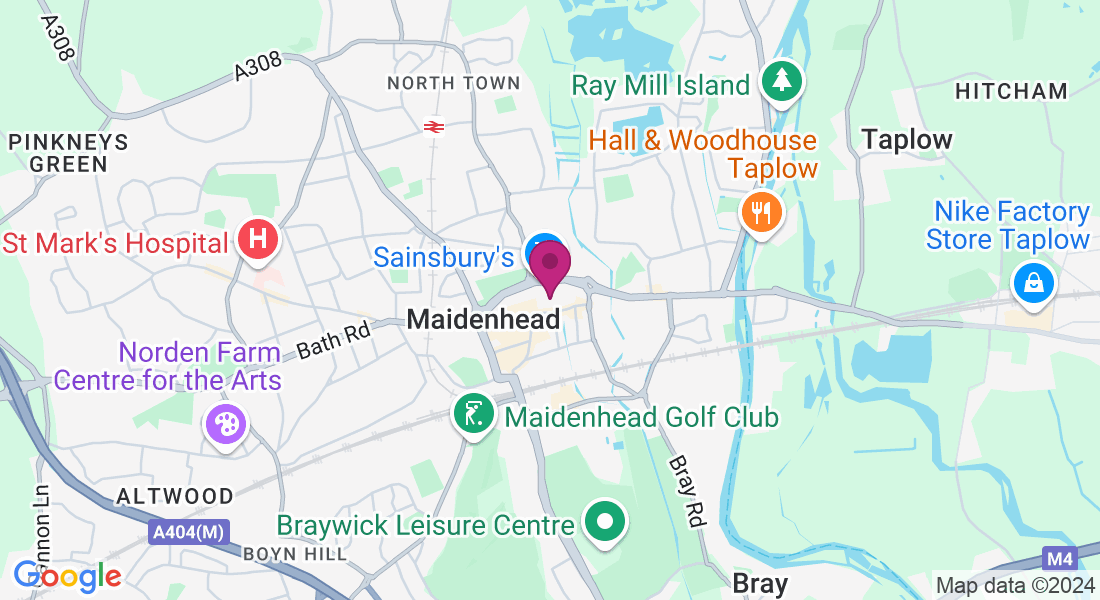

How to Find Us

First Floor, St Andrews House, St Marys Walk, Maidenhead SL6 1QZ

Immediately outside our office it is a pedestrian area, so please find below the directions on how to Find Us.

Travelling by Car – where to Park

Please use the following Postcode for your Sat Nav:

SL6 8QZ. This will take you to the Hines Meadow Pay and Display Car Park, which is right next to our offices.

Walking Directions from Sainsbury’s

Follow the pedestrian area in front of Sainsbury’s. At the end of Sainsbury’s you will see a cash point. St Andrew’s House is immediately next to Sainsbury’s on the pathway to the right of the cashpoint. The entrance to St Andrews House is down the steps. If you are unable to cope with the steps, you can use the walkway slope.

Accessibility – Stairs to First Floor

If you are visiting us and have an accessibility issue please do let us know, as we are located on the first floor and there is no lift. We can make an arrangement to meet you in an alternative location where accessibility is easier.

Ready for a Hassle-Free Mortgage? Let’s Talk!

It's free to talk to us for an initial consultation. What have you got to lose?

There will be a fee for arranging your mortgage and the precise amount will depend upon your circumstances. This fee will typically be between £399.00 and £979.00 depending on the type of mortgage that you are arranging and is payable upon Application. Your home may be repossessed if you do not keep up repayments on your mortgage. Please refer to our IDD for more details. Alton Mortgages Ltd is an appointed representative of Mortgage Next Network Limited which is authorised and regulated by the Financial Conduct Authority under number 300866, in respect of mortgage, insurance and consumer credit mediation activities only. We always aim to provide a high quality service to our customers. However, if you encounter any problems and we are unable to resolve them you can take your complaint to an independent Ombudsman. Our advice is covered under the Financial Ombudsman Service.

How to complain.